Bates Research | 08-14-24

New Data Insights on U-5 Defamation Cases

One of the key questions often at the heart of claims involving the termination of a particular advisor (commonly referred to as U-5 defamation cases) is the alleged harm caused to the terminated person by virtue of the U-5 commentary interfering with their ability to gain new employment. The length of unemployment is, as a result, a key component for estimating harm. In this article, we take a deeper look at U-5 cases and how they have been decided in the past, to see if there are insights we can leverage in service of accurate analysis.

Bates Group is often called upon to assist firms or individuals in bringing U-5 cases. FINRA member firms are required to file a U-5 within 30 days of an associated person’s termination, disclosing the reason for the termination and noting any internal review or investigation or customer complaint involving that person. Bates Group experts support these matters by providing industry expertise which covers internal review processes and procedures and related compliance, supervision, sales practice and industry reporting standards as well as calculating and rebutting damages.

Learn How Bates Group Supports Employment Dispute Litigation and Arbitration

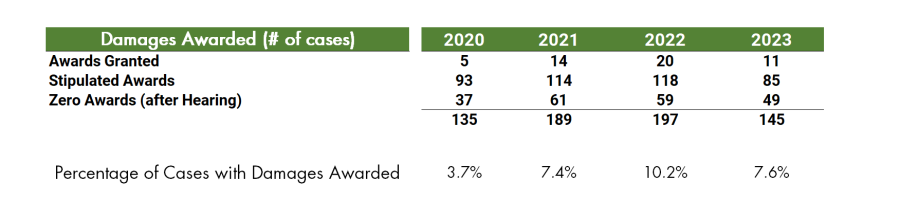

Analyzing data provided by Securities Arbitrator Commentator from 2020 to 2023 reveals the following statistics related to disputes where at least one of the reported allegations involves “Reformation (U-5).” As seen below, these are almost always Employee vs. Member claims, in which the terminated person is bringing an action against their former employer.

Damages awarded in these cases reflect liability associated with the circumstances around the termination of a registered representative’s employment with the firm. Allegations often include wrongful dismissal, breach of contract, breach of implied good faith and fair dealing, unjust enrichment, and discrimination, among others that allegedly resulted in the U-5 disclosure being defamatory in nature. In looking at how these matters have been decided in the past, we can see that the majority of cases resolved prior to hearing.

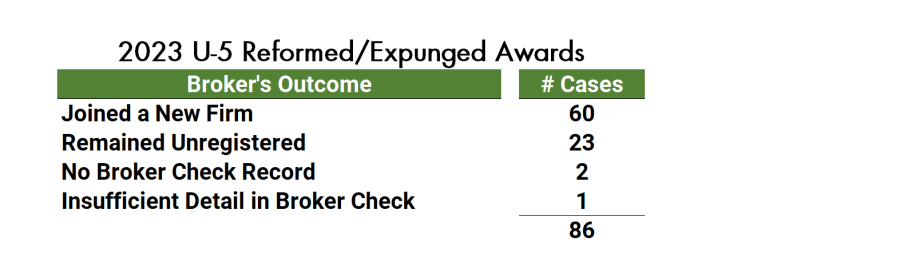

As noted above, in 2023, 86 cases involved reformation of the claimant’s U-5 disclosure. Analyzing the data from each claimant’s FINRA “BrokerCheck” report related to these 86 cases, the following observations can be drawn which can be useful in negotiating a settlement or in calculating or rebutting damages:

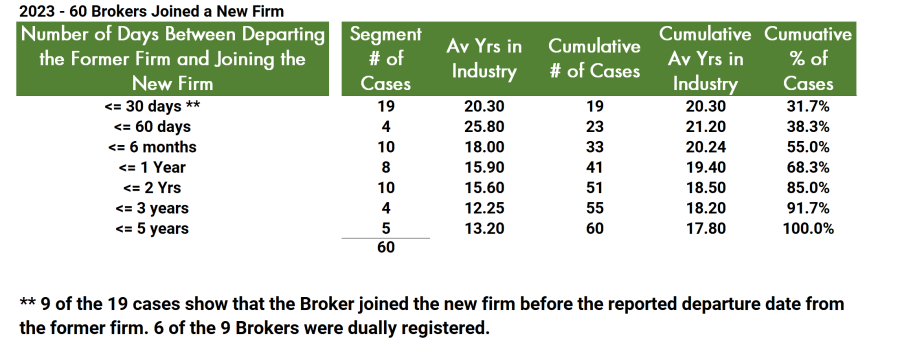

- As of May 31, 2024, 70% [60/86] of Brokers had joined a new firm.

- 55% of Brokers with a reformed/expunged U-5 joined a new firm within 6 months.

- 85% of Brokers with a reformed/expunged U-5 joined a new firm within 2 years.

- On average, the longer a broker had been in the industry, the quicker they were able to join a new firm. This is another relevant factor to be considered by an expert when assisting with a U-5 matter as it can create a base against which to measure the Broker’s expected period of transition which can impact the value of damages sought.

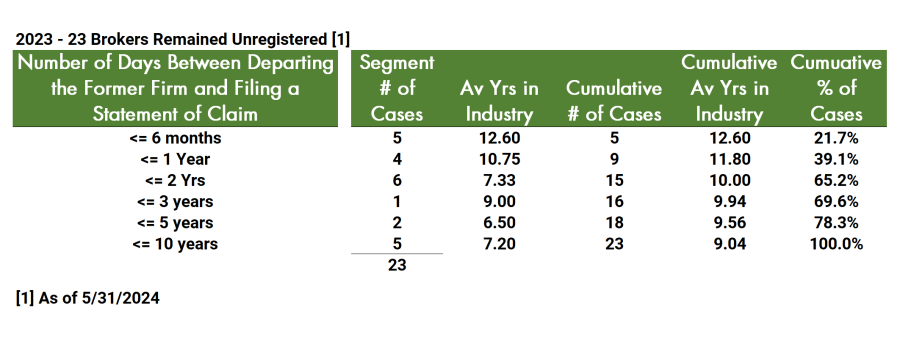

- For Brokers who remained unregistered as of May 31, 2024, the Broker who had been in the industry the longest tended to file a statement of claim sooner.

- It took more than 1 year from departure to file a statement of claim for more than 60% of the Brokers who remained unregistered as of May 31, 2024.

- It took more than 3 years from departure to file a statement of claim for more than 30% of the Brokers who remained unregistered as of May 31, 2024.

In conclusion, the data allows for a more insightful analysis of U-5 defamation matters. In particular, the data provides a rigorous basis for counsel (and experts) to assess the validity of a damages claim, and it also puts firms on notice that former employees may bring claims years after their departure.

About Bates Group

Bates Group is a financial services consulting firm that provides expert advice and guidance to our partners in compliance, litigation, and regulatory matters. Our subject matter experts are highly regarded in their respective fields. For over 40 years, Bates’ exposure to industry challenges, litigation matters, and enforcement actions has given us unique insight into matters that allow us to benefit all our partners.

Contact Bates Today