Bates Research | 03-06-24

2023 FINRA Dispute Resolution Statistics: A Look Back

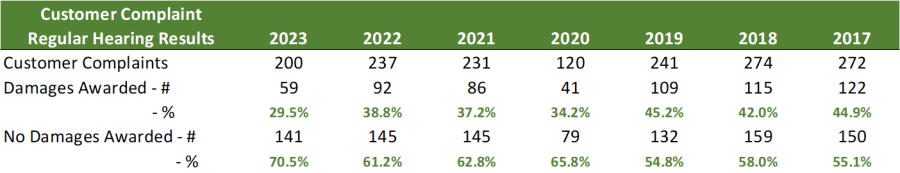

2023 was an interesting year in FINRA dispute resolution. Customer cases filed were the second lowest in the last 10 years, while intra industry cases filed increased more than 50% when compared with 2022 and 2021. In 2023 over 76% of resolved cases were either employee-member cases (379) or customer-member cases (275). In addition, the number of customer complaint cases resolved through a regular hearing, and the number of these cases where damages were awarded, were the lowest in the last seven years (excluding 2020). Interestingly, only 29.5% of customer complaint cases were heard through a regular hearing, which was the lowest in the last seven years and down 24% from 2022.

While we did see some changes in the statistics, there were some constants: the top five customer-member controversies have remained consistent over the last four years, five of the top six customer-member security types have remained unchanged over the last five years and the top eight intra industry controversies have remained unchanged over the last five years as well; although, the relative frequency of the listed customer-member security types and intra industry controversies varied considerably in 2023 – but more on that shortly.

Read our analysis of Securities Arbitration trends for January - September 2023

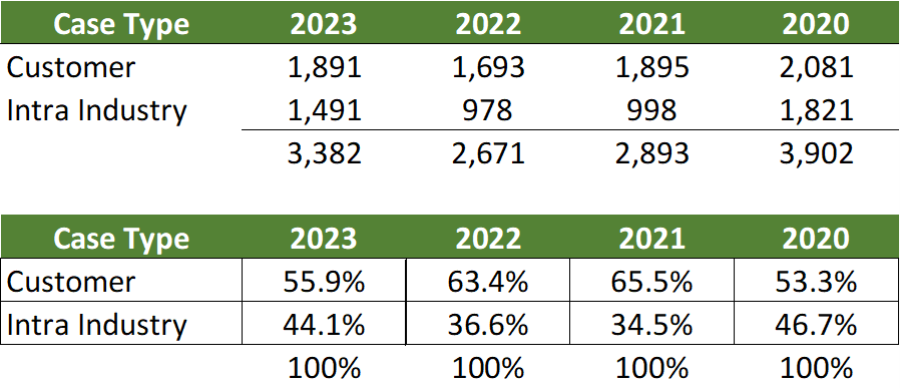

FINRA Cases Filed – up 26.6% from 2022

2023 Types of Disputes Resolved

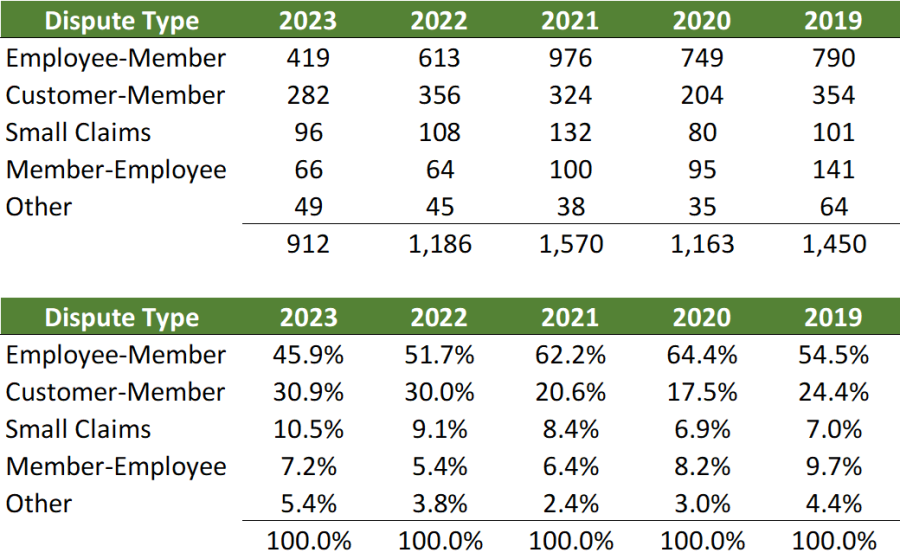

Using the Securities Arbitration Commentator database (“SAC Database”) which looks at disputes resolved through the arbitration forum, the types of cases resolved in 2023 is summarized in the table below. Employee-Member and Customer-Member disputes represented 76.9% of resolved disputes while Small Claims and Member-Employee disputes represented 10.4% and 7.2%, respectively.

Comparing 2023 with the average of 2019 – 2022 [4 years] the percentage of Employee-Member and Customer-Member disputes resolved declined 4.4% [76.9%; 81.3% respectively].

Other disputes comprised of nine different categories: Member-Member; Member-Customer; Customer-Employee; Employee-Employee; Employee-Customer; Customer-Nonmember; Member-Nonmember; Nonmember-Member and Nonmember-Nonmember.

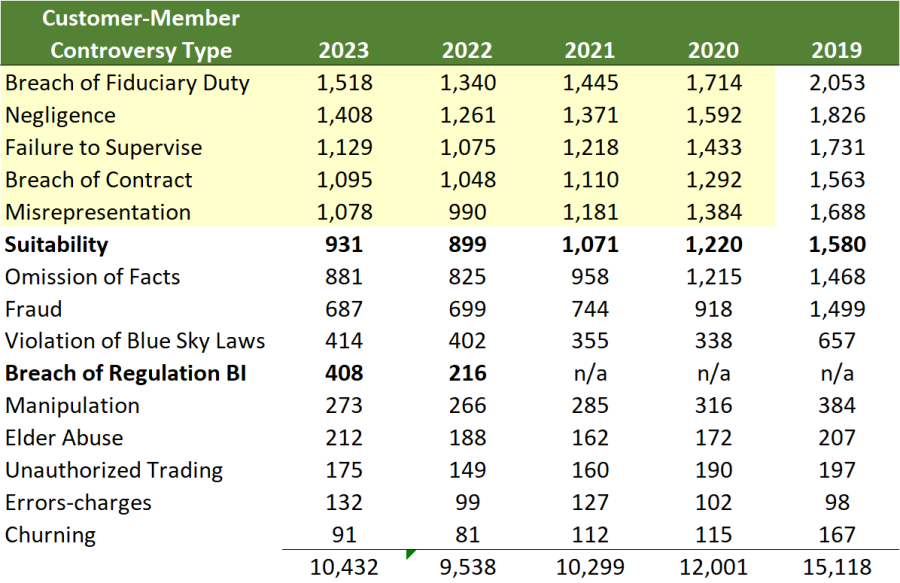

Customer-Member Cases Filed – Top Controversies

There is substantial consistency in the controversies pled in customer-member cases. The top five controversies have remained relatively stable over the last five years. With the introduction of Regulation BI, the number of disputes listing Suitability as a controversy has declined in recent years while the number of disputes listing Breach of Regulation BI has increased.

Year over year, the largest increases in controversies being pled were in Breach of Regulation BI (+88.9%), Errors-Charges (+33.3%) and Unauthorized Trading (+17.4%). Also showing double digit increases year over year were: Breach of Fiduciary duty (+13.3%); Elder Abuse (+12.8%); Churning (+12.3%); and Negligence (+11.7).

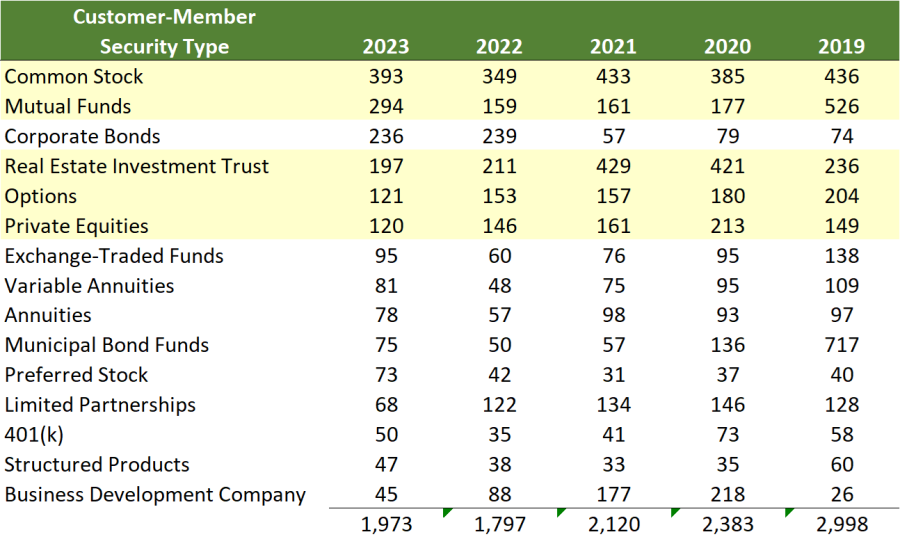

Customer-Member Cases Filed – Types of Securities

Similar to controversies in customer-member disputes, the types of securities have also remained relatively stable. The biggest change to the types of securities is that cases involving Corporate Bonds increased four-fold in 2023 (and 2022) when compared to 2021, 2020 or 2019, no doubt due to the changing interest rate environment.

Year over year the largest increases in the types of securities being pled were: Mutual Funds (+84.9%); Preferred Stock (+73.8%); Variable Annuities (+68.8%); Exchange Traded Funds (+58.3%); and Municipal Bond Funds (+50%). Largest declines in security types, year over year were: Business Development Companies (-48.9%); Limited Partnerships (-44.3%); and Options (-20.9%).

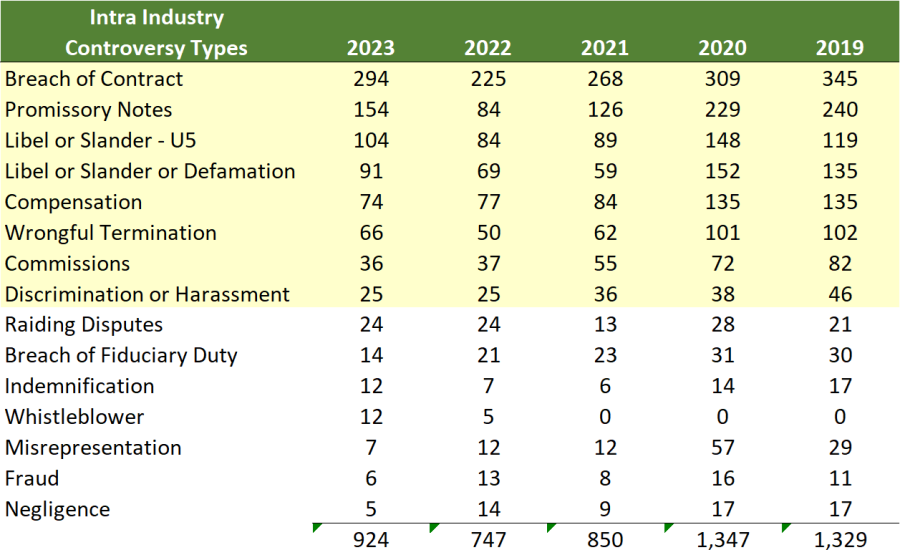

Intra Industry Cases Filed – Top Controversies

Types of controversies in intra-industry cases have been very stable over recent years. With the increase in the number of intra-industry filings, and the consistency of controversies pled, there were seven categories which increased by more than 24% year over year; five of which were in the top eight categories.

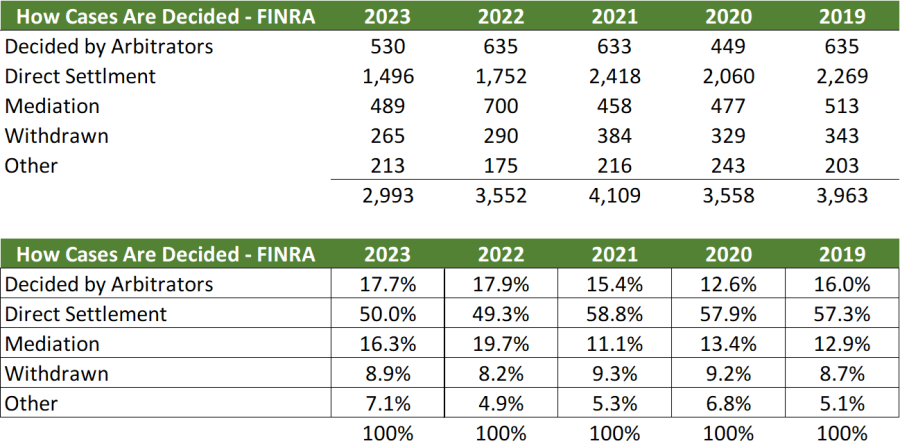

How Cases Were Decided

2023 was almost a mirror image of 2022 with 67.7% (2022: 67.2%) of cases being decided by arbitrators or through direct settlement; yet it remained 5% below the 2019-2021 3-year average of 72.7%. Cases decided by mediation in 2023 were 16.3%, 3.4% lower than 2022 (19.7%) but 3.8% higher than the 2019-2021 3-year average of 12.5%.

Results of Customer Complaints – Regular Hearing

Behind the Numbers: Awards Issued – Q4 2023

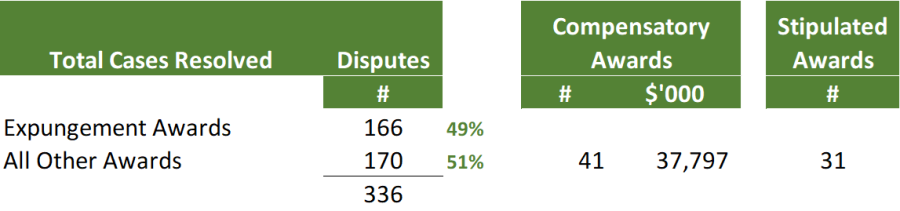

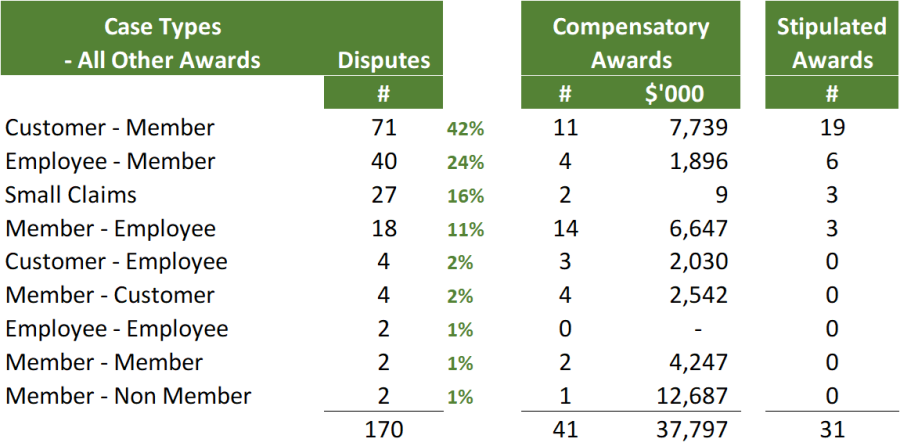

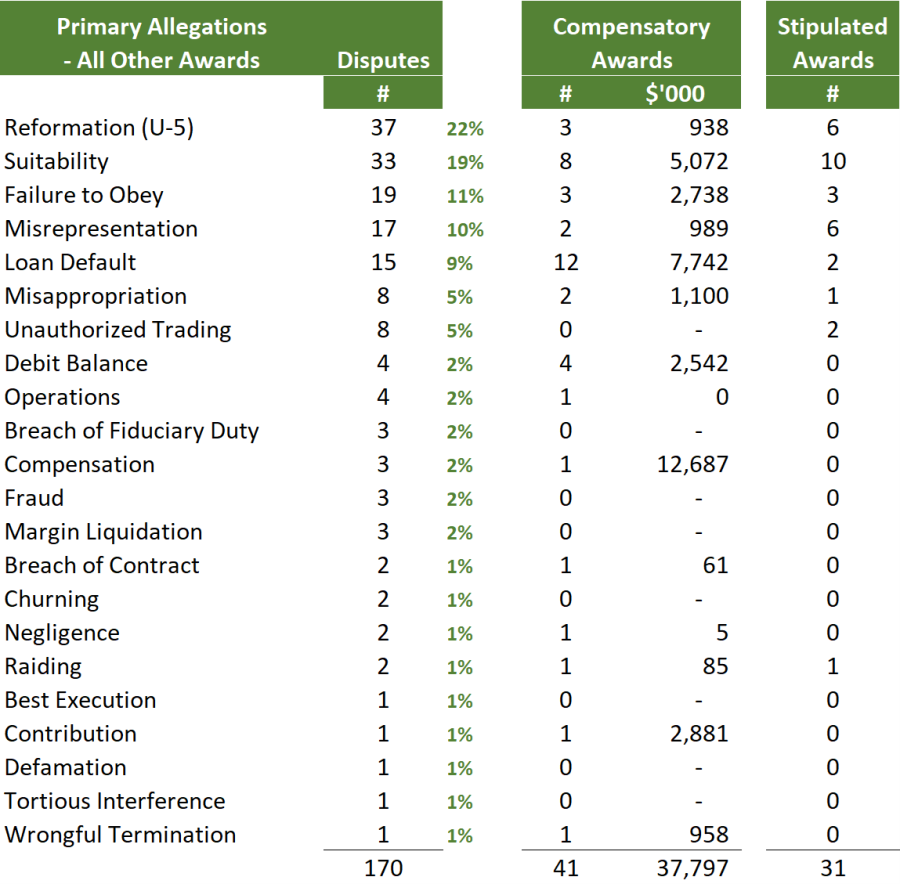

The tables below have been compiled using the SAC database of resolved disputes and provide an overview of the number of disputes where there was a compensatory award (number of disputes and total amount awarded) and the number of stipulated awards. Expungement disputes have been removed from case types and primary controversies.

Contact Bates Group for Dispute Resolution Support

The FINRA arbitration forum is constantly evolving and changing. To discuss any of the above, or how Bates Group can assist with your customer–member and employee–member cases, please contact us today.